Tara Na Rí was a landmark pub in Co Meath until its closure in recent years. From an old-style bar and shop attached to a farm at a crossroads, like so many in rural Ireland, it had grown into an established music venue but shut down in the aftermath of the pandemic.

Now its owners, the local McCarthy family, have big plans to redevelop Tara Na Rí as a modern bar, restaurant and shop with accommodation for dozens of tourists in converted farm buildings, as well as car and coach parking. As its name suggests, the property is ideally located a stone’s throw away from the historic Hill of Tara, just off a motorway exit and served by the bus network.

In the immediate, Meath County Council announced last month that the property would house 14 Ukrainian refugees, rising to up to 76 as the development progresses. When The Currency visited Tara Na Rí this week, a new 50-space park-and-ride facility managed by the council was complete and a significant construction site was active at the back of the shuttered pub.

The cost of the project is, evidently, in the millions of euro. To make it happen, company documents show that its owners obtained secured debt finance from Novellus, an alternative lender with a fast-expanding loan book in the Irish property and hospitality sectors.

But who exactly is Novellus?

*****

Novellus is a group of companies in Ireland and in the UK, where it was first established a decade ago. According to its website, it provides bridging loans for terms of a few weeks to a few months, especially those required to close a property acquisition quickly. It also offers longer-term property finance over three to five years, with rates starting at seven per cent.

“Our average loan size is slightly higher than €1 million and we are most active in the €1 million – €5 million space. We are able to offer loans from as little as €500,000 and well in excess of €20 million if the appropriate opportunities arise,” Novellus advertises.

According to its latest published balance sheet at March 31, 2023, the group’s central company, UK-based Novellus Ltd, had £114.2 million (€130 million) in loan assets on its books. Some £94.2 million of this was owed directly by customers and the rest was channelled through other group companies.

One of these companies is Dublin-based Novellus Finance Ltd, established in January 2022 to serve the Irish market directly. While the past two years have seen a surge in the number of deals financed by Novellus in Ireland, the group had backed Irish borrowers from the UK before that.

The size of the loan book originated by Novellus’s Irish subsidiary has not yet been reported in its accounts, but it is likely to run into tens of millions of euro based on The Currency’s analysis of a dozen deals identified to date, including Tara Na Rí. This is in addition to at least 17 Irish-secured borrowers backed by Novellus’s head office in the UK.

Hotels, residential portfolios and abandoned monasteries

Irish companies reporting charges on their property in favour of their lender Novellus include Authorized Property Company Unlimited, the owner of the Glenroyal Hotel in Maynooth, Co Kildare. The business was reacquired in 2022 by the Grehan family of developers, who had lost it to Nama during the financial crisis. Novellus refinanced its €11.8 million debt the following year.

Another high-profile hospitality business recently refinanced by Novellus was north Dublin’s Bonnington Hotel (previously known as the Regency). Its owner Liffeyfield Ltd, part of Jim McGettigan and his family’s business group, replaced Bain Capital with Novellus as its provider of multi-million-euro debt finance last December.

The lender is funding residential portfolios, such as the one assembled in Cork city by local businessman Donal O’Brien under the OBF Property Investment Group umbrella. Another example is the fleet of Dublin north-central apartments owned by landlord Duan Ying Chen with co-investors through several Novellus-backed companies.

Novellus has also funded farmland, business premises and development sites across the country. The lender seems to have a fondness for abandoned religious sites: It holds security over the Mount Carmel monastery vacated by nuns in Loughrea, Co Galway and now acquired by local businessman Mike Feerick for conversion into the head office of his online education business Alison.com.

Novellus also funded the acquisition of the riverside ruined abbey in the centre of Athy, Co Kildare. It is owned by a company controlled by local man Arthur Lynch and called Fortitudine Vincimus Ltd, after the motto of local historic figure Ernest Shackleton (“Through endurance, we conquer” in Latin), which is developing a recreation business called Joyathy.

“The interest rate on this loan is approximately one per cent per month.”

Novellus’s longest-running deal in Ireland has been with a group of companies owned by Co Mayo pharmacist and businesswoman Olivia Lavelle and her family. The lender backed a Lavelle company called Trean Meadow from 2017, initially through a related vehicle called Clarkson Management SA (more on this later).

Trean Meadow was acquiring a development site in the Galway suburb of Ballybrit at the time. The deal became controversial when The Sunday Times reported that Lavelle’s brother, then-Fine Gael TD Brian Walsh, had lobbied for Nama not to sell the site back to its previous owners. Instead, a local auctioneer bought the property and later sold it to Lavelle’s company. Walsh told the newspaper at the time that his Nama intervention was “in the public interest” and the Lavelle family told The Sunday Times: “We don’t discuss our private affairs with the media.”

Trean Meadow reported an initial €1 million valuation for the asset and went on to secure planning permission for the 102-unit Barr an Uisce residential complex on the site from An Bord Pleanála in 2020. The company grew the site’s book value to €2.5 million the following year, before selling it to the approved housing body Respond. Respond announced the completion of the homes last month.

Through the period it was in ownership of the site, Trean Meadow was debt-financed first by Clarkson Management SA, then by Novellus from November 2019 under the exact same conditions: “The company refinanced an existing loan and availed of additional development finance during the year for a period of one year. The interest rate on this loan is approximately one per cent per month payable in advance,” the Lavelle-owned company reported year after year.

“Our own discretionary capital”

When providing finance for these deals, Novellus prides itself on delivering “quick access to funds with no external credit committee to delay processing”. Its website states:

“Novellus underwriters are credit-backed so when terms are quoted there is one less risk of a credit committee or funding line rejecting an application. Using our own capital – ‘yes’ means ‘yes’. The flexibility afforded by our capital and experience means we can create entirely bespoke solutions and we are not restricted by many elements of criteria which you might otherwise see.

“We understand borrower profile and assets and as such, have the flexibility in our approach to apply more weight to one or the other when appropriate. This becomes particularly useful in the slightly more abstract requests, enabling us to offer unsecured lending or 100 per cent funding against an asset (if supported by a strong sponsor).”

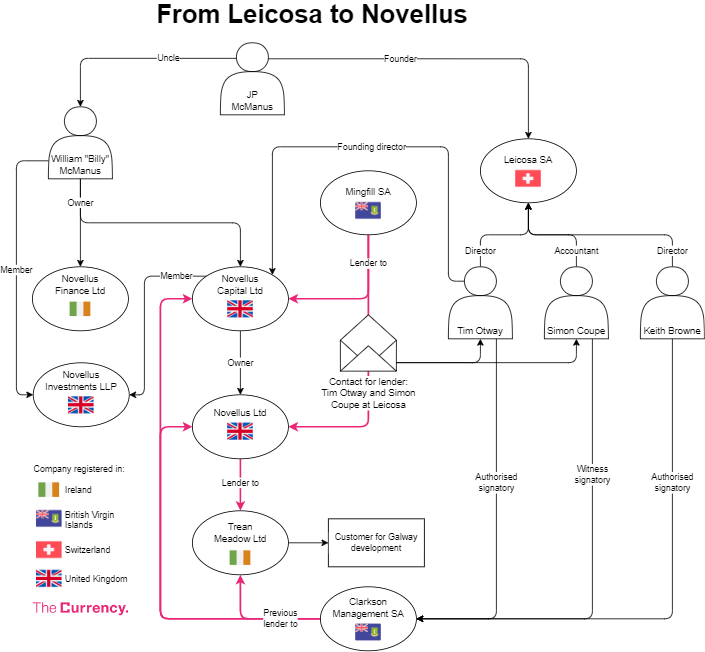

What Novellus means when it further states that it is “backed by our own discretionary capital” is that it has access to the deep pockets of Limerick-born, Swiss-resident businessman JP McManus’s family office. Although Novellus does not advertise this publicly, it is confirmed by company documents filed in Ireland, the UK and Switzerland, and analysed by The Currency.

Novellus Capital, the oldest company in the group, was founded in the UK in 2013 by its sole shareholder Billy McManus, a nephew of JP, and director Tim Otway. Swiss-based accountant Otway is a long-time director of Leicosa SA, the family office established by JP McManus in Geneva in 1994. He also sits on the boards of many businesses controlled by JP McManus, such as the Adare Manor hotel in Co Limerick where he signs off on annual accounts alongside Leicosa chairman Keith Browne.

Otway quickly left the board of Novellus Capital, leaving Billy McManus as director of this and subsequent group companies. Billy McManus has since been joined by other Novellus executives including Dublin-based managing director Niall Hurson, poached from Barclays Ireland last May. Billy McManus and Hurson did not respond when The Currency phoned the Dublin office of Novellus and emailed them directly to discuss their business.

While Billy McManus is the ultimate shareholder of all group companies, none of Novellus Capital Ltd, Novellus Ltd or Novellus Finance Ltd report being in receipt of equity funding in their latest accounts. Only Novellus Investments LLP, a UK limited partnership used to finance some British deals under this legal form, reports £11.7 million in capital obtained through “members’ other interests”, without further details.

The finance Novellus advances to customers has, instead, come from its own debt funding. Of the £114.2 million loan book on its balance sheet last year, £105.5 million came from debt raised from “other creditors” and owed after five years.

One would expect the providers of such full-risk debt backing to be secured, and the history of Novellus companies shows that they have only ever granted charges over their assets to one lender at a time. From 2015, that backer was the British Virgin Islands-registered company Clarkson Management SA, the same as Trean Meadow’s initial lender above.

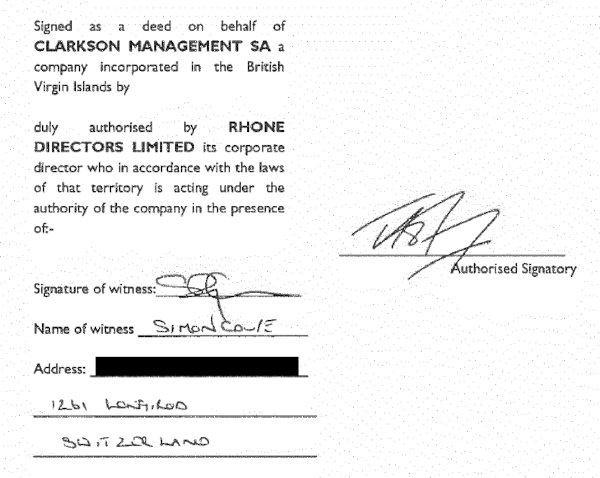

While no public information is available on company ownership or control in the British Virgin Islands, the charges placed on Novellus assets by Clarkson Management at the time carry the recognisable signatures of Otway and Browne. They were witnessed by Simon Coupe, another Swiss-based accountant who also works for Leicosa in Geneva.

The signature of Clarkson Management SA’s authorised officer in 2015 (above) is recognisable as that of Leicosa director Tim Otway when compared with a recent Adare Manor filings (below).

Since 2021, new documents have shown that Novellus debt was refinanced by a new BVI vehicle, Mingfill SA, maintained by the same corporate secretarial services firm as Clarkson Management. This time, the representatives of Mingfill have redacted their signatures out of publicly available debenture agreements filed by Novellus.

They have, however, provided contact details for the lender bankrolling Novellus. They are the email addresses of Otway and Coupe at Leicosa. The Currency contacted both accountants at the email addresses provided but has not received a response.

The consistent paper trail is, by now, abundantly clear: Novellus is the property and business lending arm of Leicosa in the UK and Ireland. It is, in other words, the bank of JP McManus here.

Flipping a 99-home site in Santry

As an unregulated lender, it will be interesting to see how it deals with borrowers in a climate defined by tougher credit and trading conditions since it launched its Irish expansion.

In one case, Novellus has already ended up taking control of a borrower company. What started as a lending relationship apparent in a charge registered against the property of Dublin-based Linbiz 2 Ltd in July 2022 morphed into a full takeover one year later, when Novellus Finance acquired the company last July.

Linbiz 2 was previously owned by Cepta Ryan, a sister-in-law and business partner of developer Bernard McNamara. The asset backing Novellus debt was a 1.4-hectare site at the centre of the Northwood development in north Dublin’s suburb of Santry. Fingal County Council granted planning permission in 2020 for the construction of 99 apartments and 3,000 square metres of office space on the site, which was to be developed in partnership with UK firm Westhill.

Now wholly owned by Novellus, Linbiz 2 last reported a €9.8 million valuation for its property. Land registry records show that it sold the site to Cairn Homes last month.

Further reading

“We need more Greg Kavanaghs”: Why Santiago is backing “gutsy” developers